You can tell a lot about different companies from their initial public offerings and private placement offerings. Just ask the nation’s corporate securities law firms, and IPO attorneys. Though it’s unclear whether it worked with a securities law firm or not, fast food chain Shake Shack recently filed their own plans for a $100 million initial public offering, which, as you might have guessed, revealed some interesting facts about the company. Here are just a few.

You can tell a lot about different companies from their initial public offerings and private placement offerings. Just ask the nation’s corporate securities law firms, and IPO attorneys. Though it’s unclear whether it worked with a securities law firm or not, fast food chain Shake Shack recently filed their own plans for a $100 million initial public offering, which, as you might have guessed, revealed some interesting facts about the company. Here are just a few.

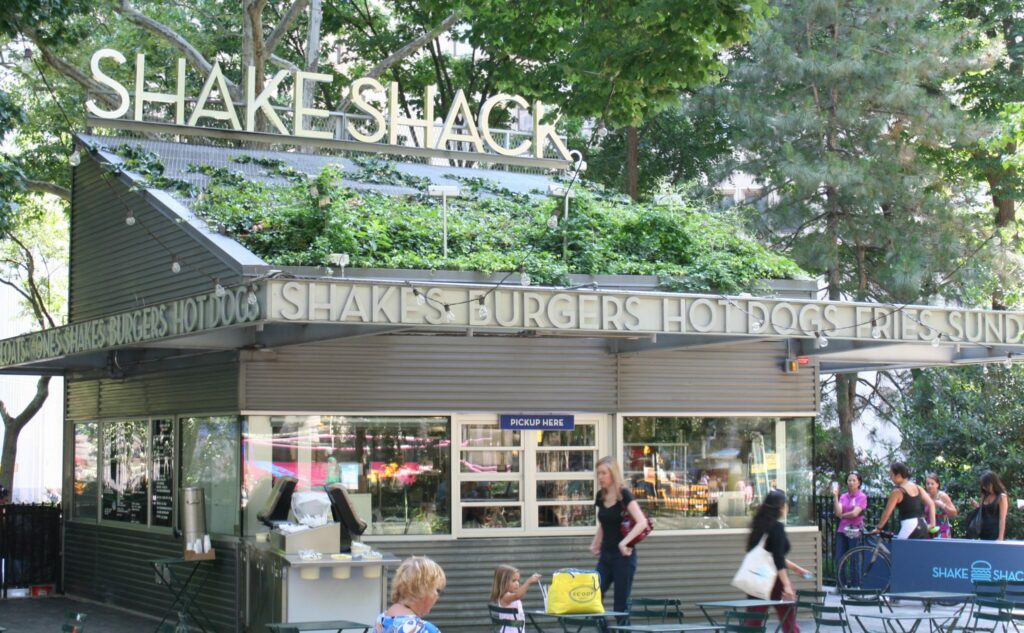

More Burgers.

According to its filings, Shake Shack plans to open 10 new company owned domestic locations per year, expanding to at least 450 outlets long-term. Maybe there will be a new Shake Shack coming to a town near you.

Fine Casual

Shake Shack is shaking off its fast casual brand for a “fine casual” one. It plans to source premium, sustainable ingredients, like all-natural, hormone and antibiotic-free beef.

Strong ROI.

Shake Shacks that aren’t located in Manhattan typically need about 3.2 years to recoup the original investment, while any new Shake Shacks opened in Manhattan only need 1.2 years to earn enough money to pay back its original investment. This might sound like a long time, but it’s really quite fast.

As the nation’s leading securities law firms can tell you, IPOs, such as Shake Shack’s, are an important part of the nation’s economy. In 2014, securities law firms were able to help companies complete an astounding 275 IPOs, topping 2013’s total of 222 by over 23% and shattering its high-water mark of $55 billion with a whopping $85 billion in proceeds. This is quite the impressive feat, as seven of the IPOs securities law firms were able to help complete were in excess of a billion dollars.

If you have any questions about securities law firms or initial public and/or private placement securities, feel free to share in the comments.