The @CFPB response to the #GOP plan to repeal #Doddfrank. Which side are you on? https://t.co/chqXvBSTaa

— Gilbert Bradshaw (@gil_bradshaw) August 1, 2016

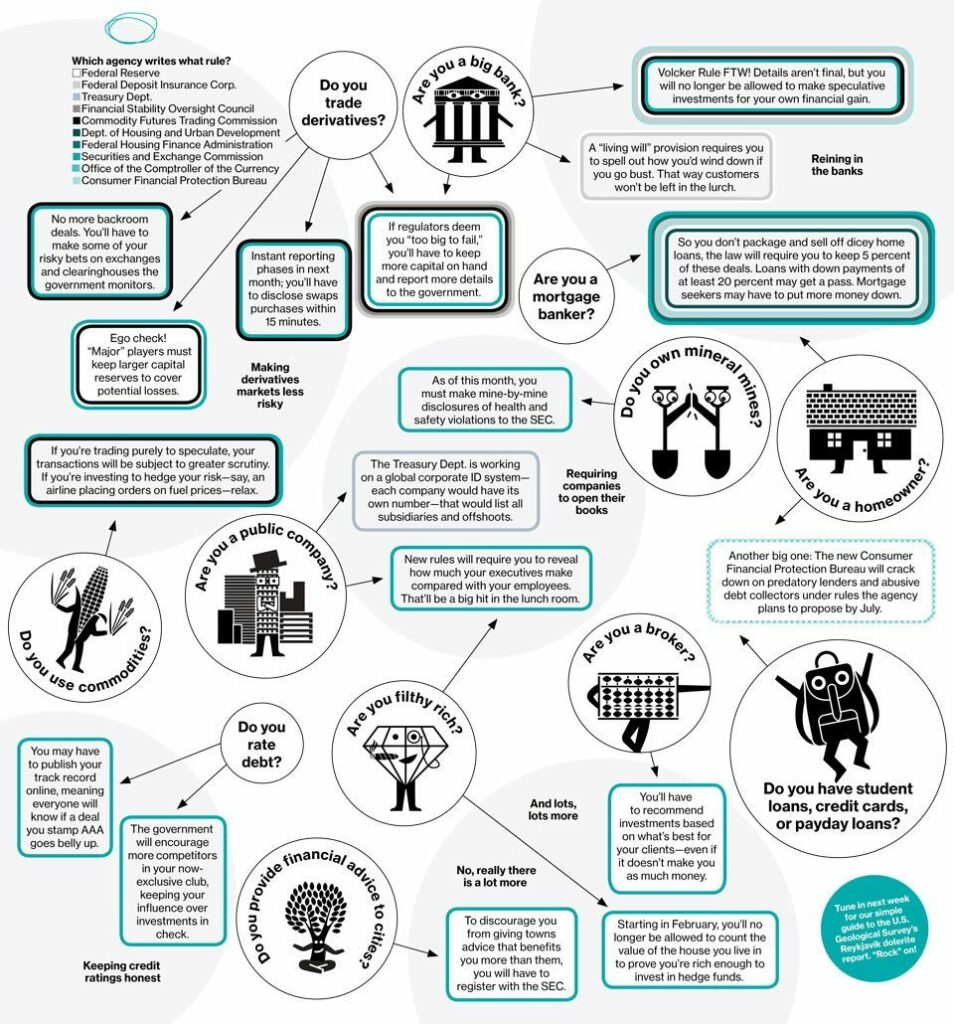

How Does Dodd-Frank Work Again?

Did you Forget what Dodd-Frank does? Here is an easy refresher infographic from Bloomberg. For an interactive chart that gets more in-depth, here is another one (my favorite actually).

What is the Dodd-Frank Act?

From Wikipedia: The Dodd–Frank Wall Street Reform and Consumer Protection Act (Pub.L. 111–203, H.R. 4173; commonly referred to as Dodd–Frank) was signed into federal law by President Barack Obama on July 21, 2010. Passed as a response to the Great Recession, it brought the most significant changes to financial regulation in the United States since the regulatory reform that followed the Great Depression. It made changes in the American financial regulatory environment that affect all federal financial regulatory agencies and almost every part of the nation’s financial services industry. The law was initially proposed by the Obama administration in June 2009, when the White House sent a series of proposed bills to Congress. A version of the legislation was introduced in the House in July 2009. On December 2, 2009, revised versions were introduced in the House of Representatives by the then Financial Services Committee Chairman Barney Frank, and in the Senate Banking Committee by former Chairman Chris Dodd. Due to their involvement with the bill, the conference committee that reported on June 25, 2010 voted to name the bill after the two members of Congress. As with other major financial reforms, a variety of critics have attacked the law, with some arguing it was insufficient to prevent another financial crisis (or more bailouts), and others contending it went too far and unduly restricted financial institutions.Has the U.S. government agencies made all of the rules Dodd-Frank directs them to?

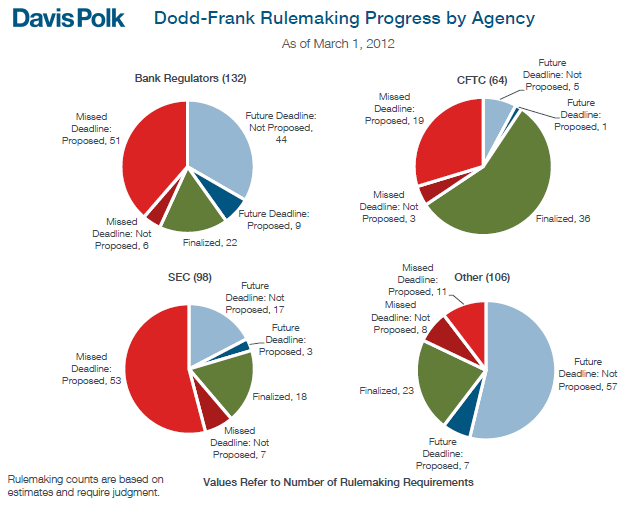

No! not even close. In fact it has been a major difficulty for the government organizations to make such rules. Davis Polk put together a Rule-making deadline for Dodd-Frank that is particularly illustrative: