Category Archives: Enforcement Proceedings

Book Review: The Hellhound of Wall Street

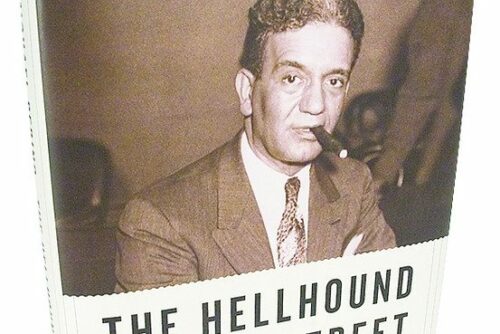

The Hellhound of Wall Street: How Ferdinand Pecora’s Investigation of the Great Crash Forever Changed [...]

04

Aug

Aug

Book Review: The Hellhound of Wall Street

The Hellhound of Wall Street: How Ferdinand Pecora’s Investigation of the Great Crash Forever Changed [...]

04

Aug

Aug

Book Review: The Hellhound of Wall Street

The Hellhound of Wall Street: How Ferdinand Pecora’s Investigation of the Great Crash Forever Changed [...]

04

Aug

Aug

How Are Bad Actors Faring under Rule 506(d)?

Since its enactment, issuers—from the smallest start-ups to the largest investments and hedge funds—have used [...]

17

May

May

- 1

- 2